33+ Mortgage tax deduction calculator

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. MAGI is mainly used to determine whether a.

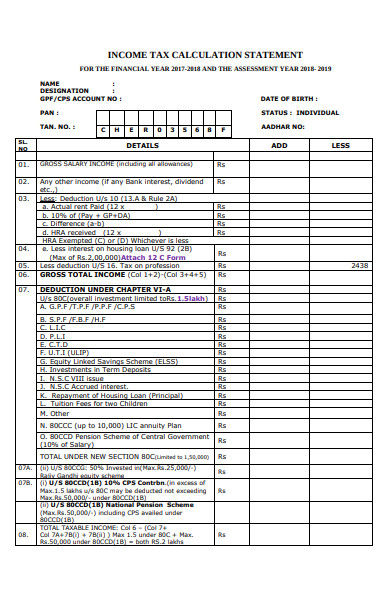

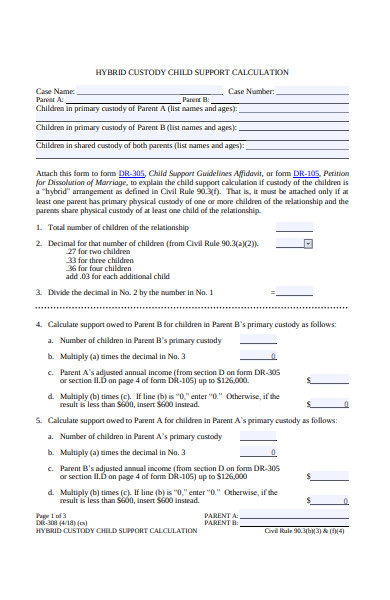

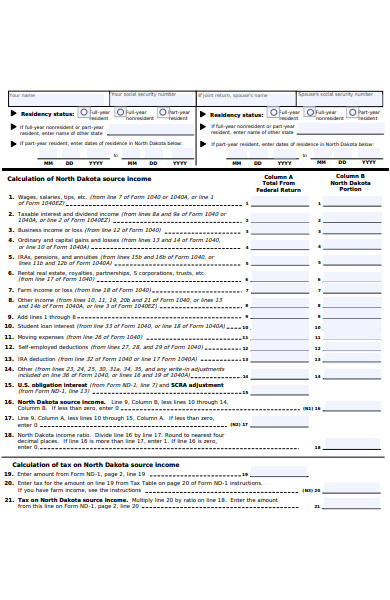

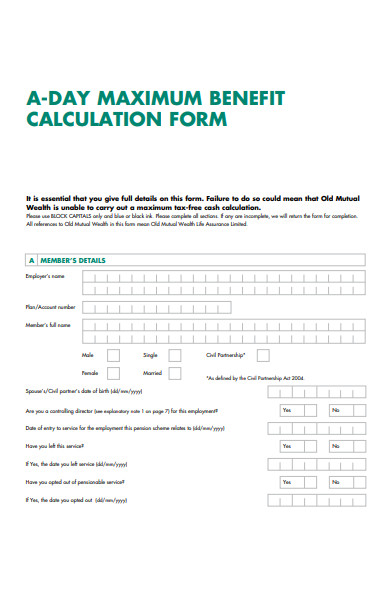

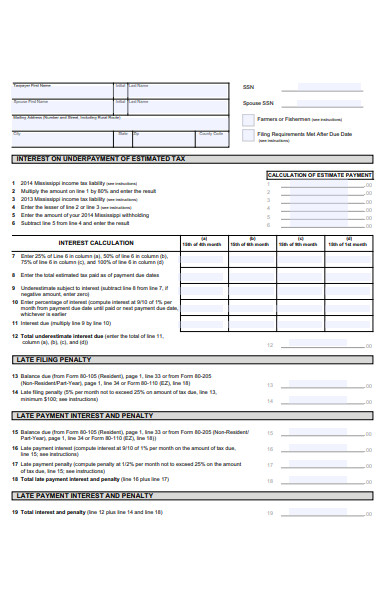

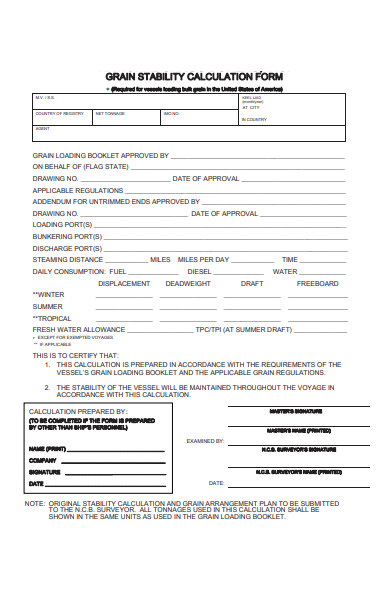

Free 31 Calculation Forms In Pdf Ms Word

Find out with our online calculator.

. For taxpayers who are single or married but filing separately the standard deduction is 12550 in 2021 increasing to 12950 in 2022. For taxpayers who use married filing separate. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or 1040-SR.

The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. A mortgage calculator can help you to see just how much you will be able to deduct from your loan though. Answer a few questions to get started.

How much can the mortgage tax credit give you tax savings. Mortgage Tax Calculator To calculate the total due to the Treasurer for a first modification amendment or extension of a prior mortgage click on the first modification link. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

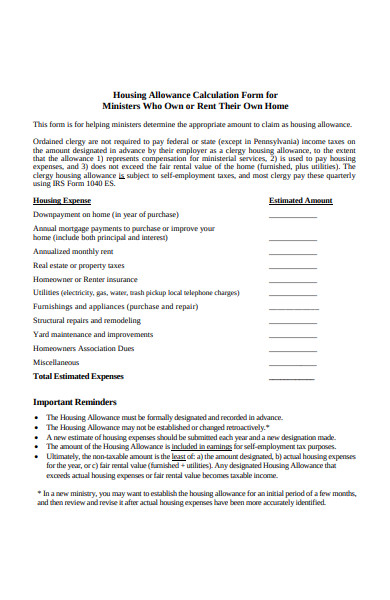

The following list shows different expenses that can be written as itemized. Taxpayers can provide itemized deductions on their tax return. You can use this as a tool to guide your estimates.

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. But for the most part only about 10 of US. Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage.

Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. Use this calculator to see how much you. Interest On Your Mortgage.

The interest paid on a mortgage along. There are options to include extra payments or annual. Todays Average 000 Mortgage Payment 134205 Refinance Payment 000 Loan Points 000 Interest Paid 572917 After Tax Payment 124107 Standard Deduction 710000.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Mortgage Tax Deduction Calculator The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. For heads of households it is.

The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt while also. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. Use the mortgage tax savings calculator to determine how much your mortgage payments could reduce your income taxes.

Accounting Line Icon Finance Management Sign Business Economy Symbol Quality Design Element Linear Style Accounting Icon Editable Stroke Vector Accounting Poster Accounti Blankstock

33 Contract Templates Word Docs Pages Free Premium Templates

Well It S A Day That Ends In Y And Right Now That Means There S More Trouble For Wells Fargo In The Last Few Weeks The Wells Fargo Fargo Consumer Lending

27 Credit Card Authorization Form Template Download Pdf In Credit Card Authorization Form Template Word Credit Card Templates Business Credit Cards

Kenny Idstein Loandepot

Free 31 Calculation Forms In Pdf Ms Word

Free 31 Calculation Forms In Pdf Ms Word

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Template Free Templates

Free 31 Calculation Forms In Pdf Ms Word

Free 31 Calculation Forms In Pdf Ms Word

Jackson Financial Inc 2021 Current Report 8 K

32 Expense Sheet Templates In Pdf Free Premium Templates

Pay Stub Calculator Templates 13 Free Docs Xlsx Pdf Payroll Template Spreadsheet Template Life Planning Printables

Free 31 Calculation Forms In Pdf Ms Word

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

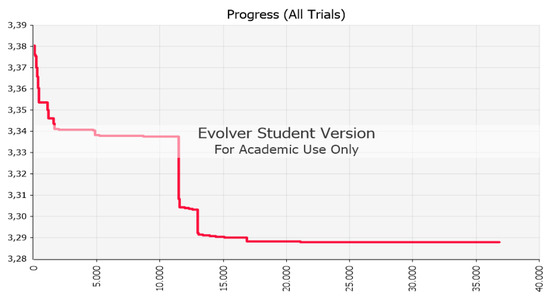

Jrfm Free Full Text Optimum Structure Of Corporate Groups Html

Free 31 Calculation Forms In Pdf Ms Word