13+ Fifo Calculator

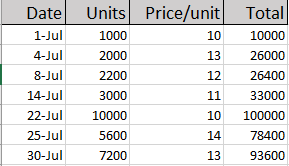

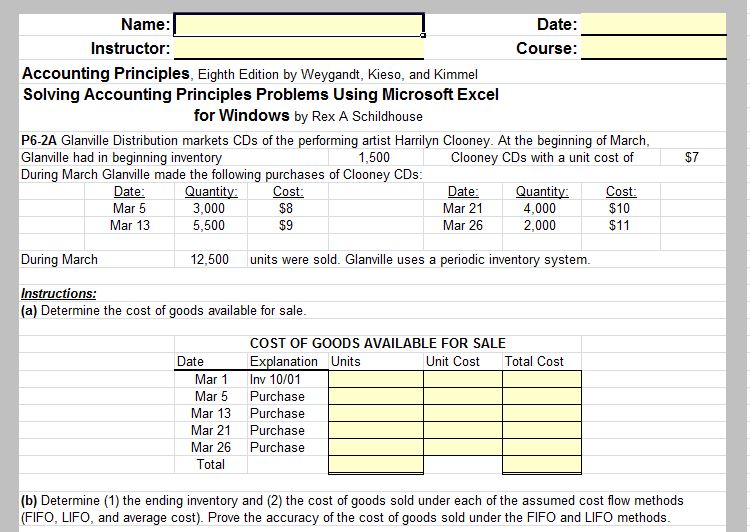

Continuing with our example above assume we sell the 10 items at a 16 USD each. In some jurisdictions all.

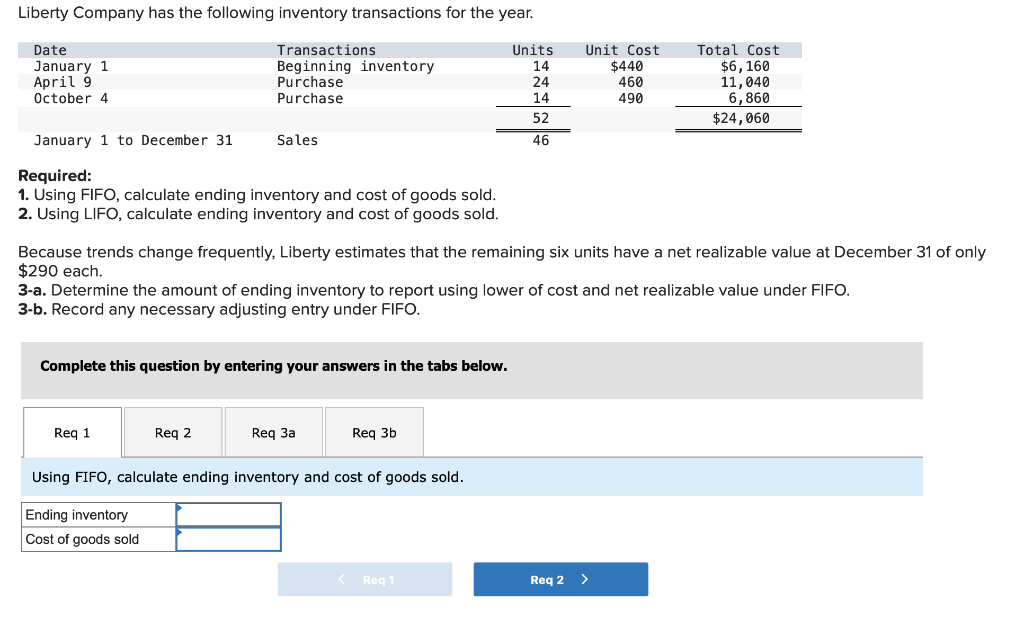

Solved Liberty Company Has The Following Inventory Chegg Com

It doesnt matter at all whether you want to calculate lifo and fifo for ending.

. It is simplethe products or assets that were produced or acquired first are sold or. Accelerate Your Grades with the Accounting Student Accelerator. This calculator gives a detailed table which contains.

LIFO ending inventory is 2500 compared to the 2925 FIFO balance. The FIFO method is the first in first out way of dealing with and assigning value to inventory. Ending Inventory LIFO Units in Ending Inventory Last Cost.

Here is a preview of CFIs FIFO. This amount is then divided by the number of items the company purchased or produced during that same period. Using this cost method 1425 cost of goods sold plus 2500 ending inventory equals 3925 total costs.

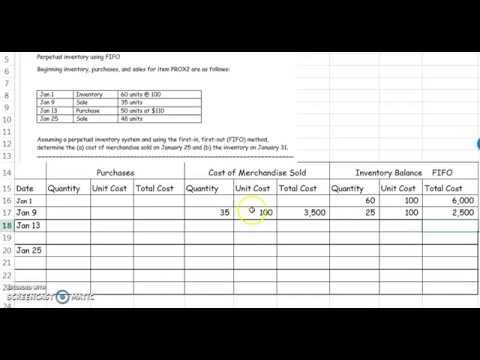

- 85 OFFFinancial Accounting Accelerator httpbitlyfin-acct-reviewManagerial Accou. FIFO stands for First-In First-Out. This FIFO calculator will help you determine the value of your remaining inventory and cost of goods sold using the first-in-first-out method.

Add More Fields. It is an accounting method in which assets purchased or acquired first are disposed of first. The First-In-First-Out or FIFO method is a standard accounting practice that assumes that assets are sold in the same order that they are bought.

This gives the company an average cost per item. What 3 formulas are used for the Inventory Method Calculator. COGS 700 Inventory 700 Under LIFO.

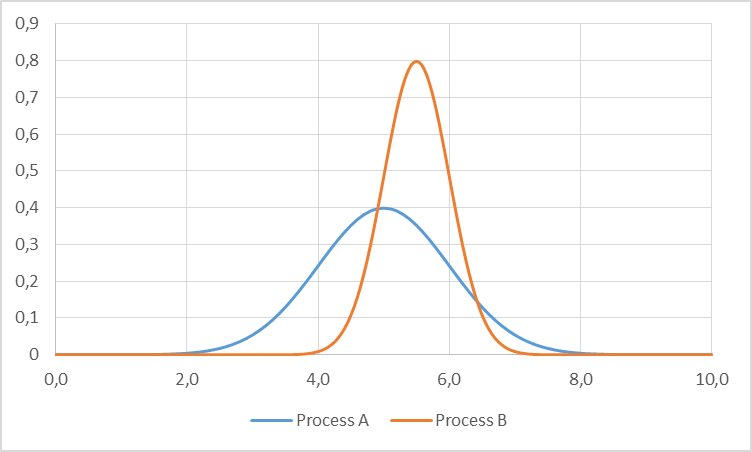

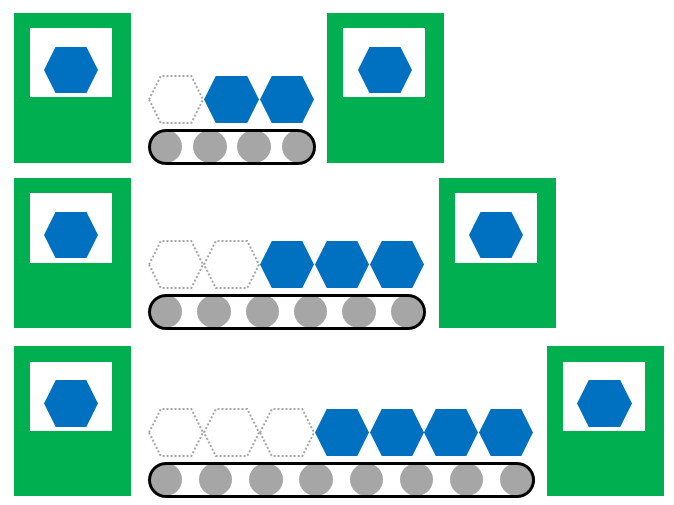

Our LIFO calculator online will indicate the total revenues and the profit margin. Probability of Process 1 being the short term bottleneck for a FiFo lengt of Zero is 55515. The FIFO method is an important means for a company to.

FIFO LIFO calculator is an online finance tool that finds the value of COGs and ending inventory on the average cost method. It is a method used for cost flow assumption purposes in the cost of goods sold calculation. Long Term Bottleneck in average slowest Process is Process 1.

Ending Inventory beginning inventory net purchases - prices of products sold Ending Inventory 30000 35000 - 45000 Add together the beginning inventory and net. Units in Ending Inventory Units available for sale - Units Sold. COGS 1050 Inventory 350 Therefore we can see that the balances for COGS and inventory depend on.

The fifo and lifo calculator calculate ending inventory cost according to first in first out and last in first out method. The FIFO method assumes. Calculate Lifo Units.

FIFO stands for First In First Out. Calculate Table of contents. March 28 2019.

With Over Online Tools. How to Calculate FIFO and LIFO Hub Accounting June 16 2022 To calculate FIFO First-In First Out determine the cost of your oldest inventory and multiply that cost by.

Determining The Size Of Your Fifo Lane The Fifo Formula Allaboutlean Com

Fifo Perpetual Inventory Method Youtube

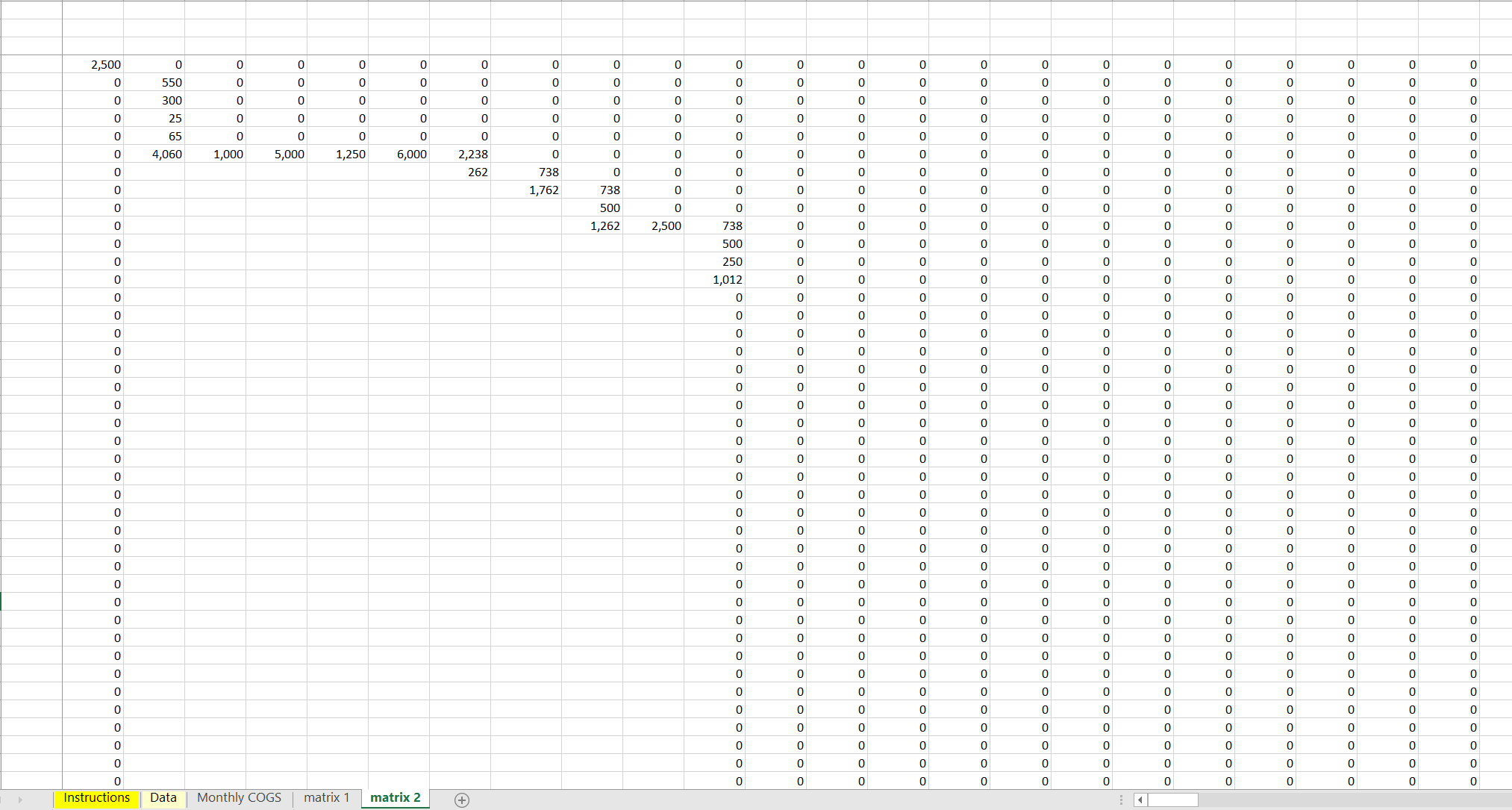

How To Value Cost Of Sales Using Fifo In Sql Server Stack Overflow

Average Costing Vs Fifo What S The Best Way To Analyze Inventory Costs Article

Multiple Equity Stocks Trading Fifo Gain Excel Calculator Eloquens

Solved 1 Calculate Ending Inventory And Cost Of Goods Sold Chegg Com

Fifo Inventory Valuation In Excel Using Data Tables How To Pakaccountants Com

How To Calculate Cost Of Goods Sold Under The Fifo Method Universal Cpa Review

Westclintech Sql Server Functions Blog Calculating Fifo Balances In Sql Server

Fifo Calculator Excel Fifo Cost Of Goods Sold Calculator Icrest Models

Determining The Size Of Your Fifo Lane The Fifo Formula Allaboutlean Com

Inventory Valuation Lifo Vs Fifo Vs Weighted Average Cost

Dax Inventory Or Stock Valuation Using Fifo Radacad

Fifo Calculator Fifo Inventory

Fifo Inventory Chart Youtube

Excel Fifo Calculator Infinidim

Excel Fifo Calculator Infinidim